“Not Just Measles”: Whooping Cough Cases Are Soaring as Vaccine Rates Decline

April 11, 2025

‘Outrageous Abuse of Power’: Trump Weaponizes Social Security for Deportation Spree | Common Dreams

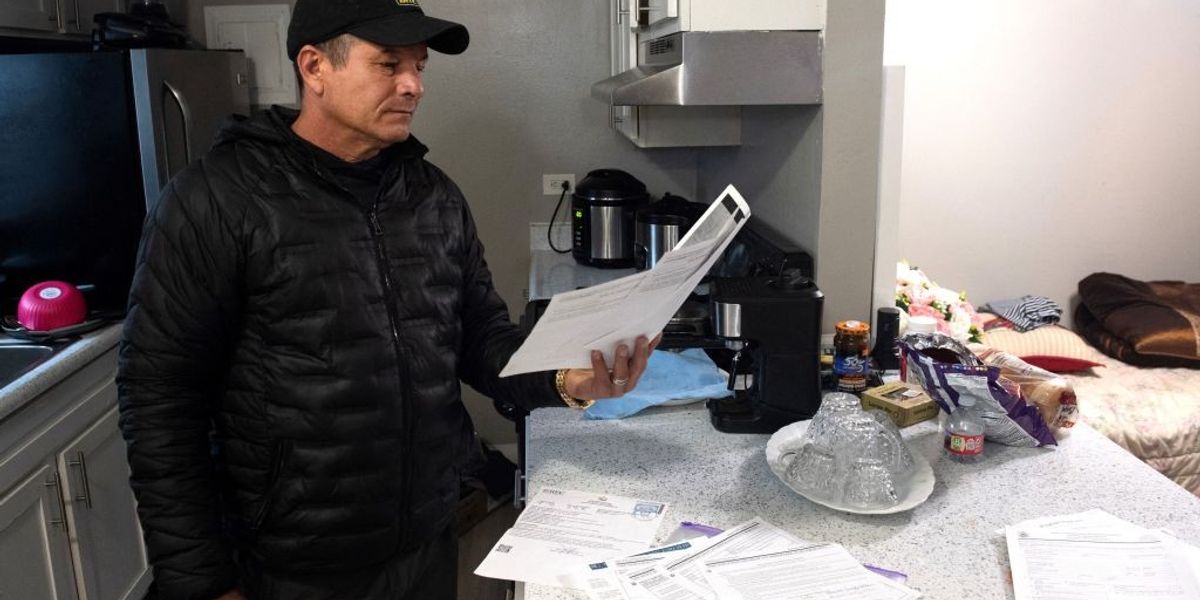

April 11, 2025Vera Warren-Williams started the Community Book Center in New Orleans with $300 and a dream in 1983. In the 42 years since, the Black book and clothing store went from the trunk of her car to a flagship shop and anchor of Bayou Road, a restaurant and shopping district with the city’s highest concentration of Black businesses.

She has battled through several economic downturns, including the 2008 recession, and the mass destruction of Hurricane Katrina. Now, she has to face the impact of one of the Trump administration’s most drastic economic policy changes in decades: imposing tariffs on virtually every country that the U.S. trades with.

The uncertainty after last week’s announcement and then Trump’s 90-day suspension of “reciprocal” tariffs on April 9 has thrown Black households and small businesses into a tailspin.

Prices are expected to dramatically rise for clothing and shoes; electronics like cellphones and computers; cars and auto repair; and groceries like coffee, fruits, vegetables, alcohol, and seafood. Economists say the sweeping tariffs may slow U.S. economic growth and increase unemployment. Nearly 80% of Black Americans are preparing to change their spending habits and buy fewer things as a result.

“It is putting people in a very uncomfortable position, and when the economy and people are uncomfortable, we’re [Black-owned businesses] the first to go,” Warren-Williams said. During the 2008 recession and the height of the COVID-19 economic downturn in 2020 and 2021, Black businesses closed at the highest rate of all ethnic groups and Black families lost the most wealth.

Warren-Williams said the Trump administration has ushered in a perfect blow to Black businesses by weakening the economy and stunting support for minority-owned businesses with his attack on diversity, equity, and inclusion.

She estimates roughly two-thirds of her products are produced outside the U.S., which will lead to increased costs for her business. And because she caters toward Black customers — who have lower disposable incomes and will need to spend their money on essentials like food over books — and corporate clients that have stopped buying as many Black books because of attacks on diversity and Black history, her sales will dwindle.

When Black businesses struggle and disappear, communities also lose social and cultural lifelines, she explained. On Tuesday afternoon, a group of retirees sat in her store for hours, not to purchase anything but just to congregate. They reminisced on the shifting neighborhood, thumbed through books they’d read before, and contemplated on how they might prepare to face the tariffs themselves. Warren-Williams plans to replace her “busted” phone before prices skyrocket, and “Mama Jennifer” who runs the shop with her, said she’s going to shift her grocery shopping habits.

“We offer a nice little vibe that can’t be measured by money or sales,” Warren-Williams said about the shop’s position as a community hub.

What are tariffs?

Tariffs can disrupt supply chains and reduce demand for certain products, potentially leading to job losses in retail stores and manufacturing. Black people are often overrepresented in these sectors, making them particularly vulnerable to job loss. Some economists predict that job losses could reach millions depending on how powerful and long the tariffs last.

Just how strong the tariffs will be on certain countries has shifted, adding to the uncertainty that households and small businesses are facing. On April 9, Trump announced a 90-day pause on “reciprocal” tariffs and the rate would be brought down to a universal 10%, a significant decrease from his earlier comments. The break did not include China. Instead, the administration is raising tariffs on its exports to 125% after the country announced a round of retaliatory tariffs. (China is the third-largest trade partner with America.)

With the constantly changing tariffs, one constant remains certain: low-income households will disproportionately feel the effects more than the average American, said Algernon Austin, economist and director of race and economic justice at the D.C.-based Center for Economic and Policy Research.

The uncertainty has shifted stock market investments in unprecedented ways. Over the past week, the stock market has been volatile. It’s seen two of its 10 largest daily losses in history, but after Trump’s April 9 announcement one week after his “Liberation Day,” the stock market saw the third-largest daily increase since World War II. By Thursday, stocks tumbled again.

Tariffs are typically used to protect domestic industries by making imported goods more expensive, encouraging local production, and serving as a tool for economic or political leverage. Still, “it’s not clear what they’re actually trying to do, but what they are doing is causing economic harm to the U.S. economy and to American people, and disproportionately to low-income households,” Austin said.

“There is a threat of a recession,” said Robert McClelland, a senior fellow in the Urban-Brookings Tax Policy Center, a nonpartisan think tank based in Washington. “The depth of a recession is unknown at this point, especially because these rates have been changing so much.”

Tariffs are taxes that countries charge on goods coming in from abroad. When products are imported, the importer has to pay these taxes at customs. Usually, tariffs are calculated as a percentage of the product’s value. For instance, if there’s a 10% tariff on an item worth $100, the importer would need to pay $10 when it enters the country.

The tariffs, however, don’t just apply to finished products, they’re also charged on raw materials and components. This can drive up costs for manufacturers, especially since modern supply chains are so complex and involve goods crossing borders multiple times. For example, car parts like engines and transmissions often cross the U.S.-Canada or U.S.-Mexico borders as many as seven or eight times during production. In that instance, the parts would be taxed every time they crossed the border.

In total, about half of the products Americans purchase are imported from other countries.

Trump said the tariffs would reverse decades of what he deemed “unfair” treatment by the rest of the world and would lead to factories and jobs moving back to the United States, but for Black Americans and small-business owners, it is not that simple.

“Black families and small businesses will be more likely to experience the pain and have more difficulty navigating this,” explained LesLeigh Ford, an associate director in the Race and Equity Division at the Urban Institute, a D.C.-based research and public policy group.

“This is distressing even for the Black middle class,” she said, also pointing to the elimination of federal jobs, which has been used to create wealth for the Black middle class.

“For many Black Americans in the middle class, they are the first-time wealth builders in their families, so there are also the psychological effects of an unexpected financial crisis removing you from that stability.”

For Alonzo Knox, a Louisiana state representative and owner of Backatown Coffee Parlour, grappling with the potential impacts of tariffs on his business also means grappling with the impacts of tariffs on his customers and constituents.

Tariffs act as a regressive tax system because lower-income households spend a larger proportion of their income on essentials like food, clothing, and household goods, which are heavily impacted by tariff-induced price increases. A family living paycheck to paycheck will struggle more to absorb rising costs for imported items such as groceries or clothing, forcing them to make tough choices about cutting back on other expenses.

Knox imports his coffee beans from Costa Rica, India, and Brazil, and expects his costs to rise substantially. But his shop is also in a majority-Black ZIP code where two out of five people live in poverty, so he knows raising prices isn’t feasible. And although he pays his employees roughly double the state’s minimum wage of $7.25 an hour, he “can’t imagine reducing salaries to bring in more people because they’re not even at a livable wage already.”

He is toying with reducing menu sizes to navigate these challenges without passing the increased costs onto its customers. But the tariffs feel like “another addition to the direct attack on Black businesses and livelihoods,” he said.

Last year, the New Orleans metro area ranked as one of the top regions for Black ownership. Still, despite Black people making up 37% of the people living in the region, just 6.2% of businesses are Black-owned. Nationwide, it is even more bleak: only 3% of U.S. businesses are Black-owned.

How tariffs will impact food and groceries

For the past seven years, Christa Barfield has worked hard to improve access to healthy and fresh food in her home of Philadelphia, the nation’s poorest large city with some of the highest food insecurity rates among major cities. Barfield is the largest Black food grower in her state and owns FarmerJawn Agriculture, which manages 128 acres across three counties there.

The food system is already fragile, Barfield said, and the tariffs are “a direct attack on our food system.” Not only will it cause supply chain disruptions and increase the costs to farm, she said, but it will put the community’s health at risk.

“We have to treat food security as such as national security, and it shouldn’t be politicized or used as leverage in trade battles,” she said. “Our ability to feed our people safely and affordably and equitably is fundamental to our national stability, and tariffs should not touch that.”

For farmers specifically, the additional tax could increase the cost of equipment such as tractors, drip line hoses for irrigation, or products like fertilizer. Then, those prices will be passed down to the farmer and onto the consumer, she said.

Rather than rely on food from overseas, Barfield is encouraging farmers and communities alike to support local food systems. Barfield’s organization educates folks on where their food comes from and empowers them to take part in their own food system, whether by planting seeds, understanding how to mix soil, or participating in cooking workshops so they can take vegetables they’ve harvested “and know what to do with it afterwards.” Other farmers are also teaching their communities how to grow.

“There’s an opportunity here that these tariffs then allow for, and that’s simply a shift to the narrative to … keep our dollars and nutrition close to home when people buy from local farms,” she said. “That’s power. That’s actually the definition of health in my mind. It builds community resilience and keeps farmers like me and others that I work side by side with who grow with care and transparency in business, and that’s ultimately the goal.”

In grocery stores, customers can expect rises across virtually every item by as much as 30%. Items that contain ingredients and packaging like plastic and aluminum from other countries will also be hit. Experts said perishable food prices will rise first, followed by shelf-stable goods. Customers should also be aware they might see smaller-sized products. This also means restaurant and bar prices will increase.

Other tariff impacts

Technology

- Consumer electronics such as smartphones, laptops, game consoles, and PC monitors will see price hikes due to tariffs as high as 125% on Chinese imports.

- Businesses reliant on technology for operations will face increased costs, which could be passed on to consumers.

- With rural and low-income households, already less equipped with technology, this could increase the “digital divide” in America.

Household Items

- Prices for everyday household goods like furniture, kitchenware, and cleaning products will increase due to tariffs on raw materials like plastics and aluminum.

- Families may see annual costs rise by $4,000 to $8,000 depending on their reliance on imported items.

- Increased tariffs on energy production inputs could lead to higher electricity bills. Black renters already spend an average of $273 more annually on utilities compared to similar white renters, a gap likely to widen under the new tariff regime.

Cars

- New car prices are expected to increase by approximately $4,000 due to tariffs on imported vehicles and parts.

- Gas prices are expected to rise.

- Repairs will become more expensive as tariffs drive up the cost of imported components like engines and transmissions.

- Insurance rates may also rise as vehicle costs increase.

401(k)s and Retirement Funds

- Retirement savings tied to the stock market are experiencing sharp declines, forcing many Americans to reconsider their financial plans or delay retirement.

Great Job Adam Mahoney and Aallyah Wright & the Team @ Capital B News Source link for sharing this story.