War on Women Report: Trump Slashes Sexual Violence Prevention; GOP Targets Teens’ Repro Rights; Nebraska Abortion Funeral Bill Threatens Miscarriage Care

April 30, 2025

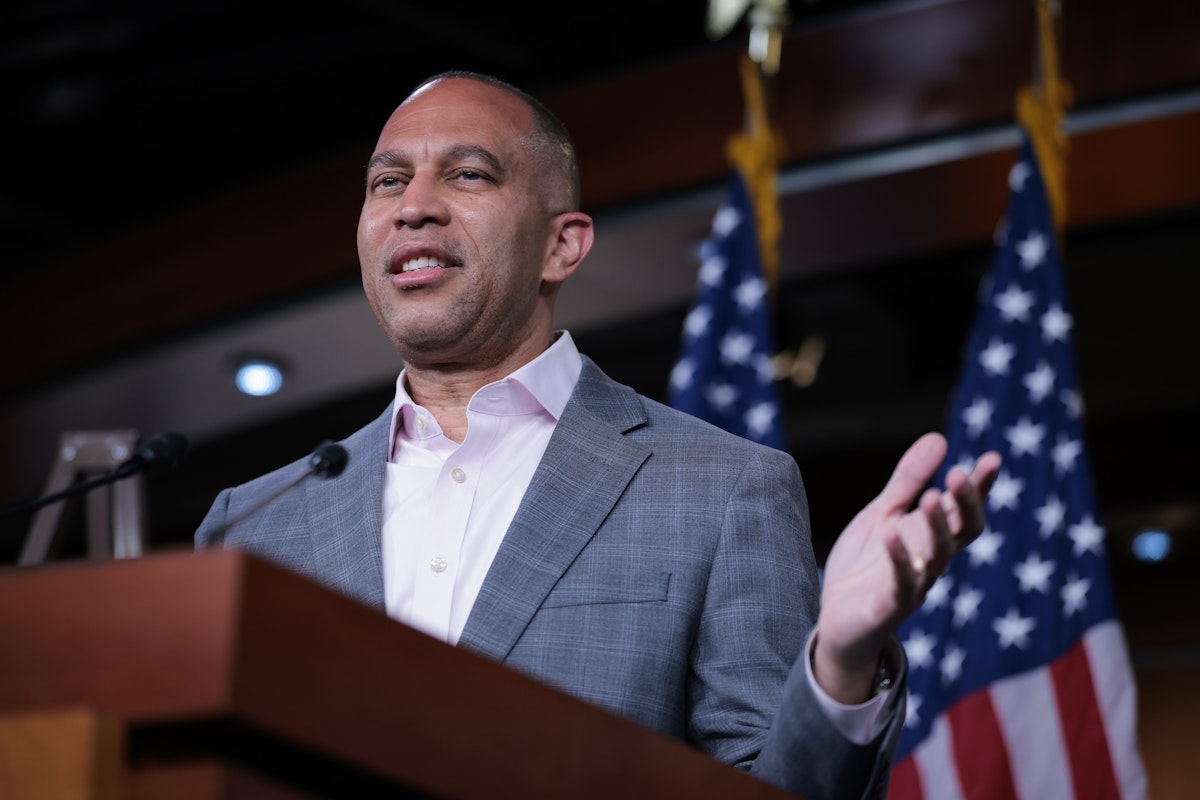

Hakeem Jeffries Reportedly Fed Up With Democrats’ Trips to El Salvador

April 30, 2025Bill Kristol sat down with Larry Summers and I cannot recommend their conversation highly enough. It’s here and you will get a great deal of value from listening. (There’s a transcript for those of you who would rather read it.)

The nub is that the United States is facing three crises simultaneously: economic, constitutional, and financial.

The economic crisis is the most easily understood: Donald Trump’s tariffs have created a supply shock equivalent to an overnight jump of $50 in oil prices. We have seen energy shocks before and their effects are well understood: The costs of all goods increase; consumption drops; jobs disappear; growth slows.

The constitutional crisis is also easily understood: The executive branch is attempting to expand its power beyond the bounds defined by the Constitution and in so doing it threatens to break the rule of law. We have not seen this before (in America), but the effects are not hard to grasp. If the rule of law degenerates, then zones of freedom contract, democracy backslides, and corruption spreads.

The financial crisis is novel because, while all happy families economic crises are alike, each financial crisis is unhappy in its own way. That’s because the financial markets, unlike the broader economy, are a black box. No one really knows—not fully—how they work, and they rely on a great deal of coordinated psychology.

In other words, in our incipient financial crisis, we don’t really understand what’s happening. We can only see the signs:

-

The stock market dropping.

-

But people are fleeing the bond market, too.

-

While at the same time the dollar is weakening.

These things are not supposed to happen together. The fact that they are tells us, as Paul Krugman discussed with me last week, that something is going on in the plumbing.

Of the three crises, the economic is the least scary. Recessions happen. They cause pain. Markets work through them. They do not tend to compound.

Financial and constitutional crises, on other hand, are terrifying for two reasons.

(1) They can snowball, expanding their scope in rapid and unpredictable ways.

(2) They do not resolve themselves. They must be fixed, from the outside, by coordinated action.

Making matters worse, the constitutional and financial realms are supposed to backstop one another.

In a constitutional crisis, the financial markets are supposed to send signals to political actors that encourage them to resolve the crisis in favor of the rule of law.

And in a financial crisis, the government is supposed to act to calm the markets and defuse the panic.

So what happens when:

-

the financial markets are going haywire, but

-

the government is off the rails and dealing with an assault on the rule of law, and

-

the unified leadership of the federal government is responsible for consciously choosing to trigger the crises?

I’ll tell you what happens.

Great Job Jonathan V. Last & the Team @ The Bulwark Source link for sharing this story.