Trump’s DOJ Has Frozen Police Reform Work. Advocates Fear More Abuse in Departments Across the Country.

April 14, 2025

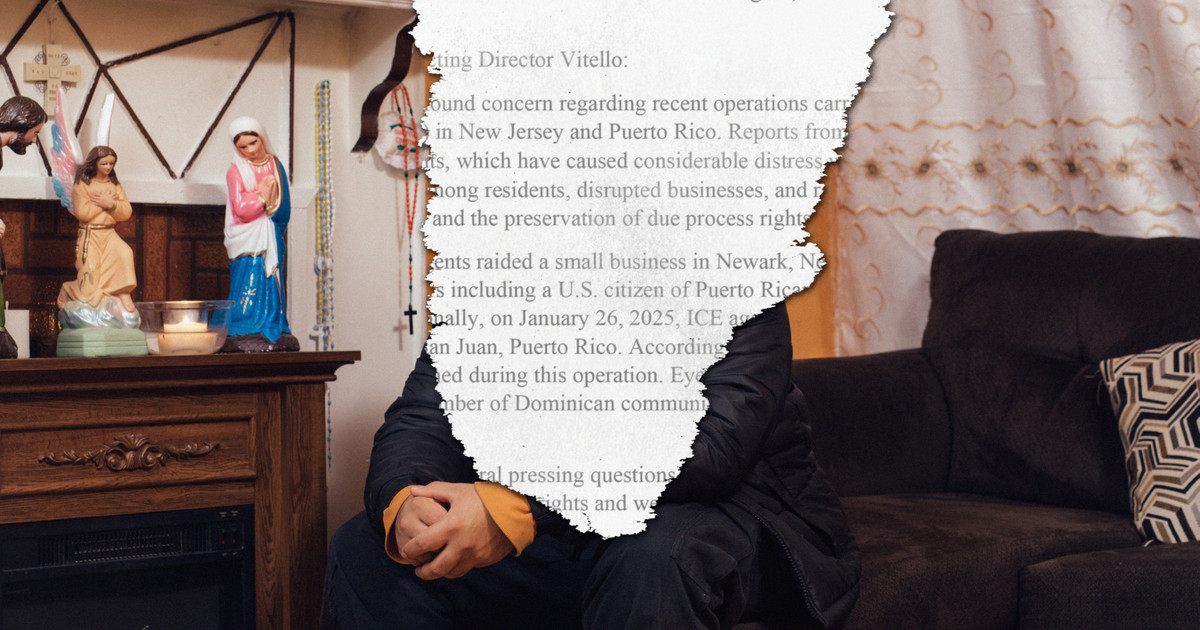

Congress Has Demanded Answers to ICE Detaining Americans. The Administration Has Responded With Silence.

April 14, 2025The rise of DeepSeek has reenergized China’s artificial intelligence industry, drawing billions of dollars in state funding and a bigger push toward self-sufficiency. Its success has also sparked a race among startups to build products and services on top of its high-performing open-source technology, even as the country’s tech giants have rushed out competing AI models.

Widening chip bans, combined with DeepSeek’s success, have pushed the Chinese AI ecosystem to innovate more quickly, strengthening its position in the global tech landscape, experts and investors told Rest of World. It has also forced startups to pivot toward more practical applications.

“DeepSeek has proven that Chinese AI labs can produce frontier models even with export control constraints,” Kevin Xu, founder of U.S.-based Interconnected Capital, a hedge fund investing in AI, told Rest of World. “Its success is also pushing more startups to work on building applications and services, and not waste time and resources building models.”

DeepSeek has proven that Chinese AI labs can produce frontier models even with export control constraints.

China lagged behind the U.S in the number of AI models produced last year, but Chinese models are rapidly closing the performance gap with U.S. models, according to a new report from the Stanford Institute for Human-Centered AI. Yet Chinese companies face several challenges, including expanded U.S. export controls limiting access to advanced chips.

DeepSeek claimed to have trained its V3 foundation model — a large-scale AI system trained on vast data sets and adaptable to various tasks — using less-advanced Nvidia chips at a cost of just about $6 million, compared to more than $100 million for OpenAI’s GPT-4 model.

DeepSeek’s efficiency claims are likely shaping investor attitudes about AI companies outside China, too, according to Melanie Tng, an analyst for global market data provider PitchBook.

“If high-performing models can be built at a fraction of the cost, it challenges the sustainability of billion-dollar training budgets elsewhere,” she told Rest of World.

Investors in China would now be wary of backing smaller AI firms still focused on foundation models, since DeepSeek’s technology makes it harder for them to compete, said Xu.

A few companies will remain “serious” about advancing AI models, “but most others will focus on building applications, services, agents,” he said. “That is where the investment will flow to.”

Chinese tech giants, meanwhile, are launching new AI models and pouring billions into research, signalling a future where only major players will compete on AI model development, experts said.

-

Meituan

- The food delivery giant is developing its own AI model, known as LongCat.

-

Baidu

- Launched Ernie Bot as a free AI chatbot, with enterprise and developer clients paying for access.

-

ByteDance

- The owner of TikTok has developed Doubao 1.5, a low-cost AI model.

-

Alibaba

- The e-commerce giant recently launched an open-source AI model in its Qwen series.

-

Zhipu

- The startup launched a free AI agent built on its own model on March 31.

-

DeepSeek

- The frontrunner of open-source AI caused waves when it launched its R1 version in January at a fraction of ChatGPT’s cost. A robust V3 model update was recently released.

AlibabaAlibabaAlibaba, founded in 1999 by Chinese entrepreneur Jack Ma, is one of the most prominent global e-commerce companies that operates platforms like AliExpress, Taobao, and Tmall.READ MORE rushed out an open-source version of its flagship Qwen large language model series on the first day of the Lunar New Year, just days after DeepSeek’s splash. The company also pledged to invest $53 billion in the next three years in its cloud computing and AI infrastructure, and is launching the next generation of the Qwen LLM series in the coming weeks.

Tencent Holdings, BaiduBaiduBaidu is a Chinese technology company that operates the country’s biggest search engine and video-streaming service iQiyi.READ MORE, and ByteDance have all launched new AI models in recent weeks. Baidu made its chatbot Ernie Bot free to the public at the start of April, ahead of schedule. Baidu CEO Robin Li hinted at the reasons for dropping the paywall earlier this year, saying the cost of model training “can be reduced by more than 90% over 12 months.” Companies still “have to invest to make sure that you are at the very front of this technological innovation or revolution,” he said.

Food delivery giant Meituan, too, unveiled its own AI model, LongCat. The company says the model is already improving operational efficiency. Meituan founder Wang Xing pledged “billions of yuan” for AI development, and promised to “play offense” to compete with other companies.

The big tech companies have an edge over their smaller rivals when it comes to foundational research, Rui Ma, founder of Tech Buzz China, an investment research platform, told Rest of World.

“It’s because monetization from purely selling model access is just not there any more with DeepSeek making it so cheap,” Ma said. “Everyone else has to become more of a product company.”

Even before DeepSeek, smaller startups were already responding to tepid investor appetite to fund research, she said.

Among China’s “six little dragons” — the country’s top AI startups — several have been forced to pivot as investor and consumer appetites have waned. Baichuan halted its model pretraining in mid-2024 to focus on medical AI services, according to Chinese tech media outlet 36Kr.

The real winners will be those who combine AI with domain expertise to deliver solutions.

Another startup, 01.ai, said last month it will adopt DeepSeek as it transitions from developing its own AI models to becoming a solutions provider, particularly in the finance, video gaming, and legal sectors.

Zhipu, however, recently launched a free AI agent built on its own model, claiming it rivals DeepSeek’s performance. AI agents execute research and personal assistant tasks, such as booking flights and ordering food.

It is a smart move to pivot to solving “real-world problems,” Beijing-based venture capitalist Celia Chen told Rest of World.

“Rather than joining the high-profile infrastructure arms race, [Chinese AI startups] can test and deploy ideas at a fraction of the cost needed to compete in building large models,” Chen said.

Despite greater state backing and a nationalistic frenzy, venture capital funding in the space remains muted.

In the first quarter of this year, venture capitalists invested $1.2 billion across 144 deals in Chinese AI and machine learning, including speech recognition and robotic control, according to data provider PitchBook. The total deal value fell 30% compared with the same period last year.

That may not be such a bad thing, Kayla Blomquist, director of the Oxford China Policy Lab, told Rest of World, since it motivates companies to make AI products in order to monetize.

“I have noticed a lot of startups are quite focused on building on top of some of these foundation models, such as DeepSeek’s,” Blomquist said. “That means that maybe [startups] won’t need such huge levels of investment and VC backing that we’ve seen … it will democratize AI in a number of ways.”

As the launch of DeepSeek’s next-generation model is awaited, another previously little-known Chinese startup, Butterfly Effect, rolled out Manus, an invite-only AI agent, last month. It claimed Manus is the world’s first general AI agent, which can perform tasks with a degree of autonomy that current AI models lack.

The company recently announced a partnership with Alibaba. Manus’ co-founder, Yichao “Peak” Ji, said the agent was developed using multiple foundation models including Anthropic’s Claude and Alibaba’s Qwen. Despite crashes and glitches, Manus has generated excitement about an entirely new generation of AI tools with a wide range of applications.

For Chinese AI companies, that may be the winning combination.

“The real winners will be those who combine AI with domain expertise to deliver solutions that big tech can’t easily replicate — like companies that help produce more accurate medical diagnostics or faster business workflows,” Chen said.

“That is where meaningful opportunities are emerging — not just for big players, but for mass-market founders as well.”

#DeepSeek #chip #bans #supercharged #innovation #China

Thanks to the Team @ Rest of World – Source link & Great Job Kinling Lo and Tiffany Ap