A Blueprint for Rights-Based Climate Action: The Inter-American Court of Human Rights’ Advisory Opinion on the Climate Emergency – Climate Law Blog | FROUSA Media

July 8, 2025

‘Her Baggage Weighs More Than She Does Now’: Jessica Simpson’s Bikini Photo Takes a Wild Turn as Fans Zoom In After 100-Pound Weight Loss | FROUSA Media

July 8, 2025The index reflects the strength or weakness of the U.S. economy. Its pops and drops are a leading indicator market participants use to make buy-and-sell decisions.

Earlier this year, the S&P 500’s massive sell-off made investors anxious. Cracks in the jobs market and worry over sticky inflation amid President Trump’s higher-than-expected tariffs have caused many to worry about stagflation or an outright recession.

Related: Goldman Sachs revamps Fed interest rate cut forecast for 2025

It’s been a different story since April.

After tumbling 19% from its mid-February high, the S&P 500 has skyrocketed since April 9, when Trump paused most reciprocal tariffs announced on April 2, so-called “Liberation Day.”

The S&P 500 has now rallied over 25% from its early April low, a remarkable performance given the index’s average annual return since 1957 is around 10%.

The robust gains have investors wondering whether stocks have run too far, too fast. This is especially true given the White House’s recent return to tough talk on tariffs and the looming end to the tariff pause approaching on August 1.

The dynamic has caught the attention of Wall Street, and Bank of America recently updated its S&P 500 target.

Image source: Michael M. Santiago/Getty Images

Fed sits, economy staggers as tariff tussle resumes

It’s not easy being Jerome Powell nowadays. The Fed Chairman is tasked with upholding the Fed’s dual mandate of low inflation and unemployment, two goals often at odds with one another.

Balancing unemployment, which rises when the Fed increases interest rates, and inflation, which rises when the Fed cuts rates, is tough in regular times. This year, it’s particularly challenging because of the mounting uncertainty associated with President Trump’s tariff policy.

Related: Legendary fund manager has blunt message on ‘Big Beautiful Bill’

The White House maintains tariffs are the best way to arm-wrestle manufacturing back to the US. However, most economists view tariffs as a consumer tax likely to increase inflation.

President Trump has enacted 25% tariffs on Canada, Mexico, and autos, 30% tariffs on China and a 10% baseline tariff on all imports. This week, he announced increased tariffs on key trading partners South Korea and Japan and, after extending the tariff pause deadline from July 9 to August 1, said no further extensions would be granted.

Unfortunately, that does little to help give the Fed the clarity it needs to embrace dovish rate cuts, like it did late in 2024. Until there’s certainty on tariff levels from trade deals, the Fed is left to wonder if additional rate cuts could fan inflationary fires even as the impact of tariffs on inflation hits.

The Fed’s hesitancy to lower interest rates creates a problem for the stock market. Stocks follow revenue and profit growth over time, and worries that inflation will slow household and business spending somewhat cap forward revenue and earnings outlooks.

As a result, some are struggling to justify the S&P 500’s massive rally since April, given the benchmark’s price has increased much faster than forward earnings estimates, lifting valuation to worrisome levels.

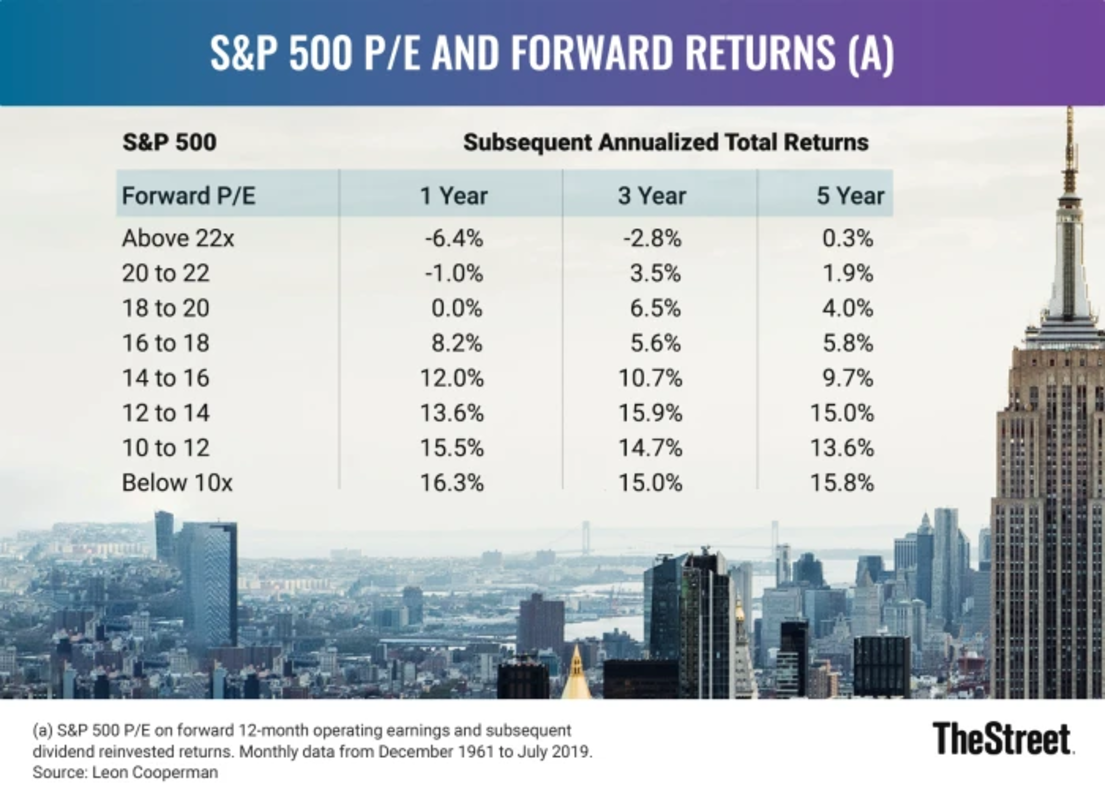

Analysts’ forward 12-month earnings estimates have increased by just 1.2% since March, while the S&P 500 has gained about 11%, inflating the S&P 500’s forward price-to-earnings ratio to 22.2, according to FactSet.

That’s meaningfully higher than the S&P 500’s average forward P/E ratio over the past five and ten years, which are 19.9 and 18.4.

Importantly, historically, the S&P 500 has struggled to generate returns in the year following a P/E ratio this high.

Bank of America boosts its S&P 500 target

While valuation is concerning, Bank of America isn’t convinced that stocks have run out of steam. The popular Wall Street investment firm increased its S&P 500 target this week, citing corporate American resiliency.

Related: Who saves money due to ‘Big Beautiful Bill’ tax cuts?

“It’s dangerous to underestimate Corporate America,” wrote Bank of America strategist Savita Subramanian. “The US isn’t exceptional, but corporate America might be.”

The analyst concedes that despite progress on trade deals, passage of the One Big Beautiful Bill Act, and lower recession risks, uncertainty remains high, propping up yields on Treasury bonds. Still, policy uncertainty hasn’t translated into worrisome levels of corporate uncertainty.

“Most co’s have continued to guide on profits, and estimate dispersion (a measure of EPS uncertainty) is near post-COVID lows,” wrote Subramanian. “Volatility in currency, inflation and rates have failed to rattle S&P 500 margins since COVID — corporates either adapted or dropped out of the index.”

The ability to adapt doesn’t mean risks don’t exist, though, which could cause short-term problems for stocks.

The strategist rates the short-term outlook for the S&P 500 as “tepid to cool” due to a lack of catalysts. The medium-to-long-term outlook is “warm,” though, because while sentiment has improved, it is “nowhere near dangerous euphoric levels.”

“Deregulation and a pick-up in business investment could buoy markets ahead of mid-term elections,” wrote Subramanian.

Subramanian admits long-term S&P 500 returns could underwhelm because of the index’s current valuation. Still, the analyst’s latest number crunching points to a higher, not lower, price target.

After adjusting equity risk premium and bond yield assumptions, Subramanian comes up with a 12-month S&P 500 target of 6,600.

Related: JPMorgan delivers blunt warning on S&P 500

Great Job Todd Campbell & the Team @ TheStreet Source link for sharing this story.

Great Job Felicia Ray Owens & the Team @ FROUSA Media Source link for sharing this story.