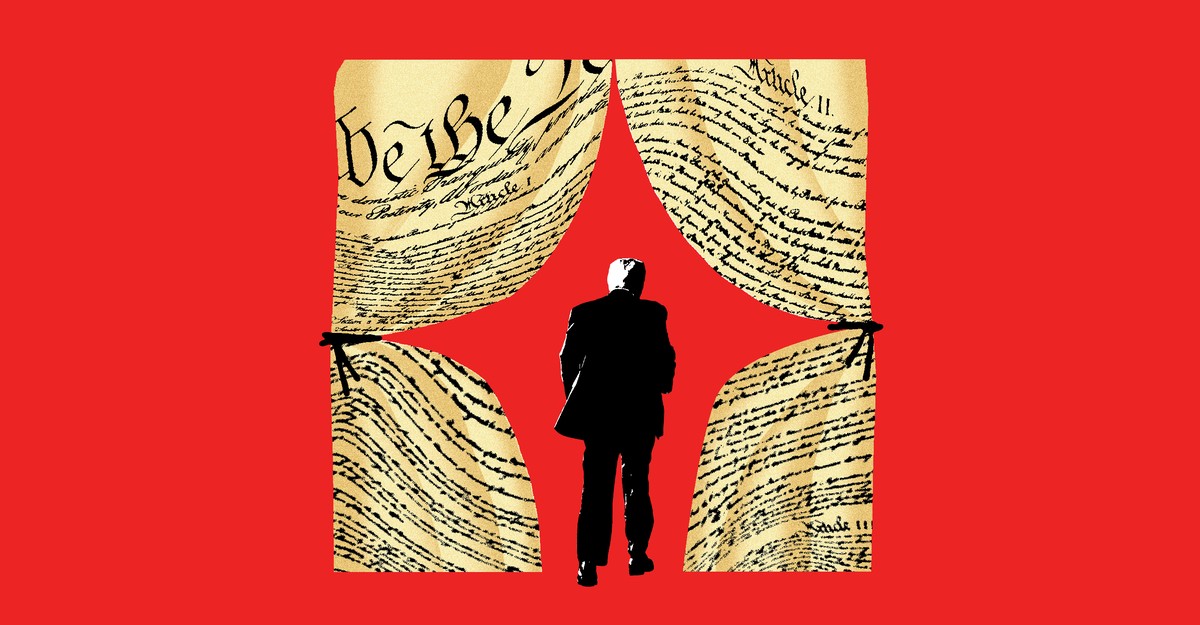

Outsmarting the Constitution

May 14, 2025

Why So Many People Still Assume That Mom Knows Best

May 14, 2025Far from increasing taxes on the rich, the House bill cuts them by extending Trump’s 2017 income tax cut, which reduced the top marginal rate from 40 percent to 37 percent on income above $731,201 for married couples filing jointly and above $609,351 for single taxpayers. According to the nonprofit Institute on Taxation and Economic Policy, 65 percent of the cuts go to the top 20 percent in the income distribution (i.e., households that earn more than $153,000) and 28 percent go to the top 1 percent (households that earn more than $787,712).

Even more skewed, ITEP found, was a provision in the 2017 bill that gave a 20 percent deduction on “pass through” income: that is, income from a small business. Small businesses tend to receive favorable tax treatment because of what former TNR editor Michael Kinsley has called an anthropomorphic fallacy that small businesses are “owned by small people.” In fact, 92 percent of this benefit goes to the top 20 percent in the income distribution and 55 percent (i.e., most of it) goes to the top 1 percent. Half of the benefit goes to millionaires.

During the 2024 campaign, Trump promised working-class voters that he’d eliminate taxes on tips and on overtime, and the House bill includes these proposals. I argued then that these were trivial changes intended to distract from Trump’s lousy regulatory record on tips and overtime. In the case of tips, Trump wouldn’t support eliminating the $2.13 hourly subminimum wage for tipped employees and instead giving them a $7.25 hourly minimum like everyone else. The $7.25 minimum is of course scandalously low—and Trump did nothing about that in his first term. In the case of overtime, Trump extended eligibility in his first term to about one million workers; Biden set that regulation aside and expanded overtime to four million workers. Biden’s rule was blocked after the election by two reactionary federal judges in Texas. The Trump Labor Department filed an appeal, but only as a placeholder while Labor Secretary Lori Chavez-DeRemer finds out how much overtime coverage the White House will stomach. In the meantime, the appeals court has issued a 120-day stay.

#Republican #Tax #Bill #Screws #Working #Class

Thanks to the Team @ The New Republic Source link & Great Job Timothy Noah