Millions of People Depend on the Great Lakes’ Water Supply. Trump Decimated the Lab Protecting It.

May 6, 2025

The Missing Branch

May 6, 2025Argentine President Javier Milei has an ambitious plan to transform Argentina into a global hub for nuclear energy. Nuclear energy, in turn, is the key to his goal of making the country a center for artificial intelligence, powered by investments that he hopes to draw from big tech firms.

At the heart of the energy plan is the construction of a small modular reactor, a type of transportable nuclear reactor assembled on site, which can power a wide range of applications, including AI data centers. If successful, Argentina could be the first country in the world to have a commercially available SMR, and only the third after China and Russia to have an operational one.

“AI is going to drive an exponential growth in energy demand. We don’t have it; there’s no way to supply it,” Demian Reidel, Argentina’s chief presidential adviser, told Rest of World.

The answer, he said, is SMRs. “What’s going to happen in nuclear [energy] is so important strategically that it can put Argentina at the front of this energy revolution for the world.”

Milei is not the only one thinking about nuclear power. It is a “key part” of the infrastructure required to meet the surging demand for electricity driven by the AI revolution, Goldman Sachs said in a report in January. Big tech companies including Amazon, Google, and Microsoft have struck deals worth billions of dollars with operators and developers of nuclear energy to fuel U.S. data centers. The U.S. recently announced it is investing $900 million to advance SMRs.

Argentina, too, is eager to produce SMRs and sell significant stakes in them to global tech companies. Even though the country has vast energy reserves — the Vaca Muerta formation in Patagonia hosts major deposits of shale oil and gas — SMRs are the best way to supply the expected demand, said Reidel. New large data centers require energy “that has these three characteristics: clean, scalable, and stable. The only thing that really hits the three of them is nuclear,” he said.

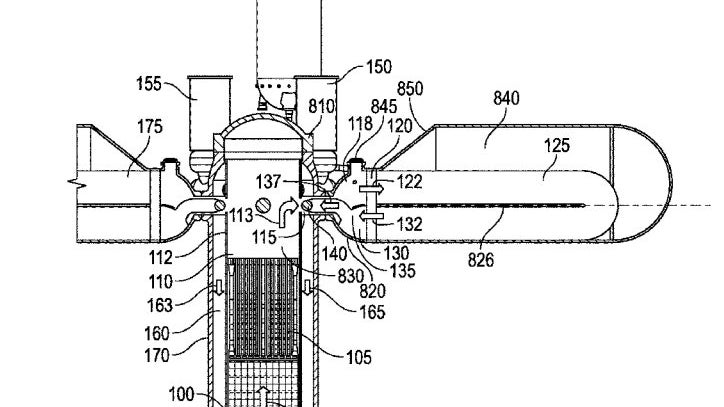

Invap, an Argentine state-owned tech company, patented an SMR called the ACR-300 in the U.S. last year. The project, which aims to produce four ACR-300 reactors to begin with, is backed by an unnamed American investor, Reidel said. Argentina, he added, will not invest any money into the reactor but will be a stakeholder instead, though he did not disclose what percentage the state will own or how this new structure would work.

Milei has been courting big tech firms to bring them on board. In May 2024, he went on a whirlwind tour of Silicon Valley, and met with Elon Musk, Mark Zuckerberg, and Sam Altman, among others. So far, no major investments from U.S. tech companies have been announced.

Some Argentine nuclear scientists doubt the country’s nuclear plan — which envisions building the first SMR by 2030 — is feasible.

The ACR-300 “has no engineering detail of any kind,” Adriana Serquis, former president of Argentina’s National Commission of Atomic Energy (CNEA), told Rest of World. “This kind of announcement of the Argentine government is to say something for people [to] cheer.”

CNEA did not respond to questions about the nuclear plan. A spokesperson for Argentina’s secretary of innovation, science, and technology also declined to comment.

Argentina’s dreams of producing its own SMR precede Milei: In 2014, the CNEA started construction on CAREM, a nuclear power reactor developed entirely in the South American nation. But shortly after taking office in December 2023, Milei slashed funding for CNEA. Last year, construction on the CAREM project — which was about 85% complete — ground to a halt as about 470 workers were laid off.

At the time, Germán Guido Lavalle, the current head of CNEA, told local media CAREM was not “economically competitive.”

The Argentine Nuclear Council, a newly created government agency, is in charge of the current nuclear plan. Milei appointed Reidel as head of the council, which also includes Lavalle and two national ministers.

The ACR-300, which is the first phase of Argentina’s nuclear plan, will be operational in five years, according to Reidel. But that timeline is highly unlikely, Koroush Shirvan, a professor of nuclear engineering at the Massachusetts Institute of Technology, told Rest of World.

“It takes 2 million hours to design a nuclear reactor,” Shirvan said. The HTR-PM, China’s first operational SMR, took about 11 years from construction to commercial operation.

Invap declined to comment on the ACR-300 or the nuclear plan.

Other scientists are enthusiastic about Argentina’s ambition. “My technical opinion is that [the ACR-300] is very attractive,” Alfredo Caro, a professor at George Washington University and the former director of the Bariloche Atomic Centre, a CNEA research and development organization, told Rest of World. Because it is slated to use off-the-shelf components, it can be done at a relatively low cost, he said.

During the second phase of the nuclear plan, Argentina will begin mining and exporting uranium, the main source of fuel for nuclear reactors, and cement the country’s status as a nuclear-powered AI hub, Reidel said.

Phase three of the plan involves building Nuclear City, a fossil fuel-free hub for nuclear-powered data centers in Patagonia serving global tech companies. Negotiations with companies to invest in data centers are “very advanced,” Reidel said, without providing further details.

Google did not respond to requests for comment from Rest of World. Nvidia, Microsoft, and Oracle — which was reported to be exploring the possibility of opening a data center in Argentina in 2024 — declined to comment on investments in nuclear power in Argentina.

A spokesperson for Amazon told Rest of World the company’s “current nuclear energy investments are based in the U.S.” Microsoft and Amazon have recently pulled back from some of their data center leases in the U.S. and overseas.

Estimates of the number of data centers in Argentina range from 29 to 35 data centers, according to market research firms.

While interest in the country’s data center market is increasing, SMRs are a harder sell.

“SMRs are experimental and unlikely to be approved by local councils soon,” Niccolò Lombatti, a digital infrastructure analyst at BMI, a London-based research firm, told Rest of World. Meanwhile, Argentina continues to rely on fossil fuels, which accounted for 84% of the energy consumed in the country in 2023. Only 2% came from nuclear power.

Then there are labor challenges. Last month, workers at CNEA went on a strike against Milei’s nuclear plan, the termination of the CAREM project, and low salaries. Dozens of workers, technicians, engineers, and other specialists at the state’s nuclear companies and agencies have recently quit because of low salaries, an engineer who works at CNEA told Rest of World. The SMRs shouldn’t be used to power data centers, at least initially, he said, requesting that his name be withheld because he feared repercussions from authorities.

“Argentina is a very large country … with the need to connect many towns that are not on the national power grid,” the engineer said. “That is what the SMRs could be used for.”

Construction on the ACR-300 has yet to begin in the Atucha Nuclear Complex, where two of Argentina’s nuclear power plants are located, about 120 kilometers (80 miles) northwest of Buenos Aires. A company spokesperson took a Rest of World reporter on a tour of its headquarters in San Carlos de Bariloche, a city nestled in the snow-capped mountains of the Patagonia region. The site is home to Invap’s satellites and models of its nuclear research reactors and radar systems.

Last month, Reidel was named head of Nucleoeléctrica Argentina, the state-owned company in charge of operating Argentina’s nuclear power plants.

“This is my baby. My idea,” said Reidel. “And we have the planets aligned for this.”

#Argentina #hopes #attract #Big #Tech #nuclearpowered #data #centers

Thanks to the Team @ Rest of World – Source link & Great Job Catherine Cartier and Facundo Iglesia