A nuclear physicist, a nonprofit executive and a construction manager: How one family has fared in Trump’s first 100 days

April 30, 2025

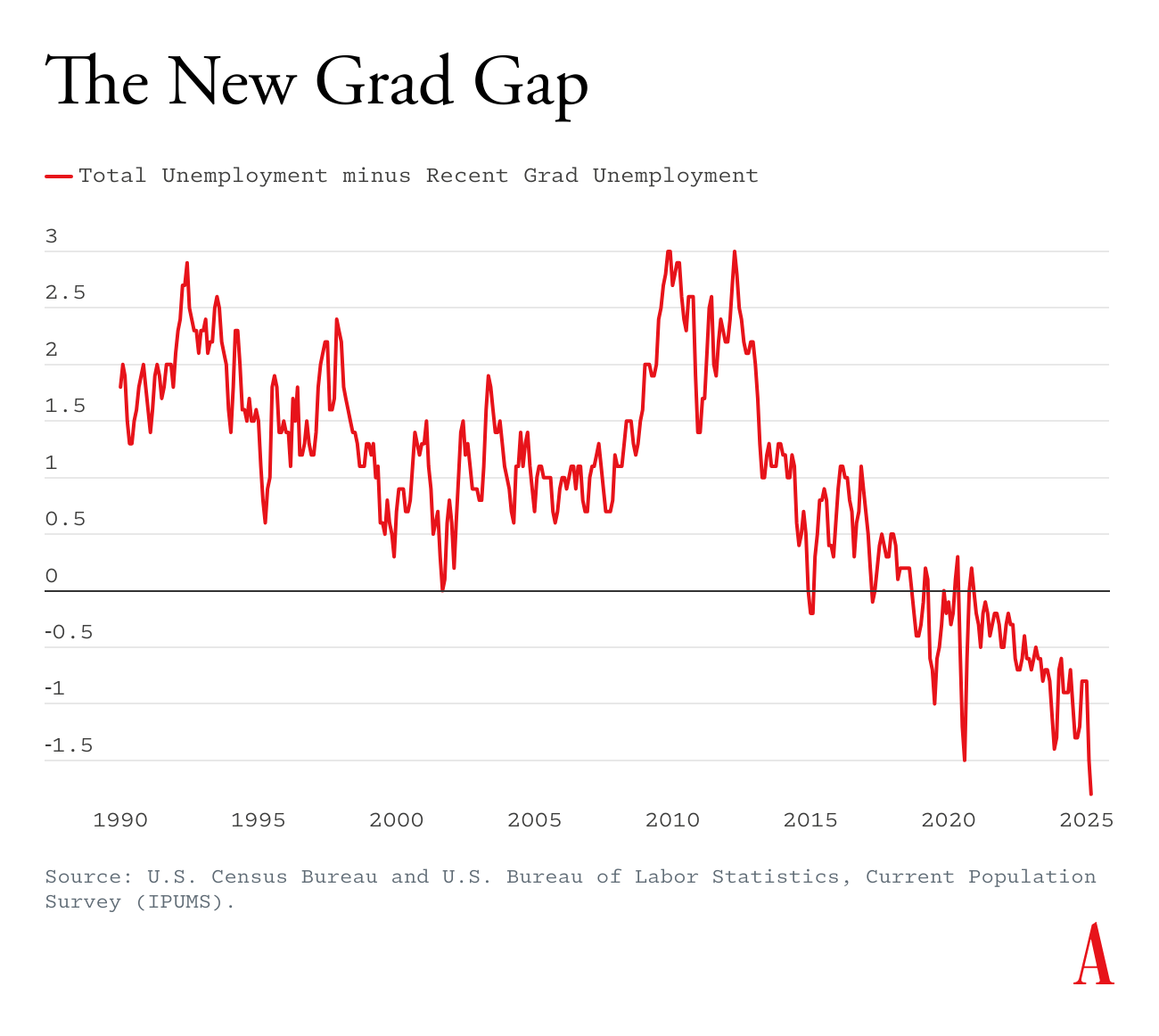

A New Sign That AI Is Competing With College Grads

April 30, 2025One evening last September, Pitambar Panda, a 24-year-old product designer in the Indian city of Pune, mounted his pearly white electric Ola scooter. He accelerated noiselessly through the city’s busy avenues on his way home from work.

When he was shopping for a scooter a few months earlier, Panda, short on funds, chose to go electric to save on gas. He was one of the founders of a small food-delivery app, for which he sometimes made deliveries. Affordable, stylish, and loaded with features, the Ola S1X Plus was a natural choice. It offered a range of 150 kilometers (93 miles), a top speed of 90 kilometers per hour, and a novel keyless start system that could wake the scooter up when he entered a password on his phone. At just 96,000 rupees ($1,125), it was cheaper than the alternatives.

And it was built by one of India’s most popular startups. Founded in 2010, Ola had grown from a successful ride-hailing service to become an electric-vehicle manufacturer in 2021. The media frenzy around the launch was full of breathless stories covering everything from colorways to delivery dates. Meanwhile, Ola’s CEO, Bhavish Aggarwal, was being touted as a visionary. “[Ola] just seemed like the best option to me,” Panda told Rest of World.

But as he drove through traffic that September evening, Panda recalled, the scooter’s screen suddenly glitched: PARKED and SYSTEM ISSUE flashed in blue on the 7-inch monitor between the handlebars. The motor shut down, slowing the scooter suddenly. A motorbike smashed into Panda, and flung him from the scooter. He fell hard on the asphalt, breaking his collarbone in half.

Prithiviraj Gopinathan

Panda spent a week in the hospital, where the doctors implanted metal plates into his shoulder. When he returned home, he wrote a LinkedIn post about the accident, including a photo of himself in a sling, his X-ray, and an image of the scooter’s display screen showing a jarring combination of his 24kph speed and the declaration PARKED. He also recounted how he’d been experiencing odd problems with his Ola from the start — like the scooter shutting down to automatically update its software when Panda was stationary at traffic lights — and had tried and failed several times to get help from the company’s customer service. “Great job, Bhavish Aggarwal,” Panda wrote. “I hope you’re enjoying this success.”

Aggarwal is one of the most recognizable faces in India’s startup industry. With his boyish smile and boisterous personality, he rose to fame in the mid-2010s while still under 30 after besting Uber to make Ola Cabs India’s top ride-hailing app. Seemingly leaping from one success to another, he then adopted a new mission of revitalizing and greening the domestic scooter industry in India, where people buy five times as many two-wheelers as cars.

“Just like the revolution that gave us our freedom in 1947, this one will give us our freedom from petrol,” Aggarwal declared at the launch of the scooter business in August 2021. Often referred to as India’s Elon Musk, Aggarwal has matched the Tesla CEO’s penchant for social media feuds, long workdays, demanding expectations of employees, and towering ambition. In recent years, he has also repeatedly praised India’s Hindu nationalist prime minister while positioning himself as a patriot working to take his country to new heights. “Tesla is for the West; Ola is for the rest,” Aggarwal has often said in his public appearances.

Debarchan Chatterjee/NurPhoto/Getty Images

As for Ola’s scooters, Aggarwal vowed: “Quite simply, it is the best scooter ever built.”

Over 100,000 people preordered scooters on the day Ola Electric opened reservations. By April 2024, the company had cornered over half of the domestic EV scooter market. Ola Electric’s subsequent IPO last August made Aggarwal one of India’s youngest billionaires. But since then, with increasing speed, the company has fallen back to Earth, stymied by a declining market share, a sinking share price, and a series of scooter failures that have left some riders scratched, bruised, or worse.

Drivers have reported that their Ola scooters spontaneously combusted — and in viral videos from across the country, some scooters can be seen smoking and aflame. Drivers have also recounted dangerous accidents caused by scooters shifting into reverse at full acceleration. In one such incident, a 65-year-old man reportedly received 10 stitches on his head after his Ola tossed him into a concrete wall. One man claimed his son’s scooter accelerated when the brakes were applied. Some Ola scooters have had their front suspensions snap in half. A woman was hospitalized with severe facial injuries when the front wheel of her scooter broke away mid-drive. Ola said this incident was caused by a road accident. It has pushed back publicly on other claims — once saying that a scooter fire was caused by faulty aftermarket parts, and in the case of the scooter that allegedly accelerated while braking, blaming the driver for speeding. At the launch of Ola’s new scooter line in January, Aggarwal jokingly suggested the safety issues had been exaggerated: “Many people fan the fire, pun intended.”

The company’s share price has sunk by a third since its high last August. So far this year, Ola has sold fewer electric scooters than the established domestic two-wheeler brands it once dominated, TVS and Bajaj. It has also fallen behind Ather, another Bengaluru-based scooter startup.

Aggarwal has been pilloried on social media by critics. In September, one frustrated customer set an Ola showroom on fire in Karnataka; a month later, someone at a service station in Delhi told a journalist he was so angry he also wanted to burn one down. In October, Ola stock dipped 10% when Aggarwal got into a Muskian fight with a popular comedian on X who had criticized the company’s after-sales service. Meanwhile, Ola’s signature cabs business has fallen well behind its rival Uber, while attempted expansions into food delivery and e-commerce have failed to take off. Through it all, buoyed by foreign venture capital, Aggarwal has remained as bullish as ever, seemingly unmoved by Ola Electric’s falling sales numbers, shortening market share, and rising chorus of complaints.

Rest of World interviewed nearly a dozen former senior Ola employees to explore what has gone wrong at the company and whether Aggarwal can turn things around. All spoke on condition of anonymity — even those who had nothing but positive things to say. “I am in the startup domain, and I would [like to] continue for the next two decades of my career, ” said one former executive, who spent much of an hourlong interview praising Aggarwal for his problem-solving and business acumen. Those who’ve worked with Aggarwal closely find him undeniably brilliant, with a penchant for obsessively attacking and solving big problems.

Some former executives also said that Aggarwal micromanages and routinely berates even his senior hires, leading to chronic instability. Nearly half of Ola Electric’s employees departed in the last fiscal year, including several senior executives. Amid Ola Electric’s rapid expansion, meanwhile, the company has fallen short on execution. Repeated safety mishaps and inadequate servicing have led to more than 10,000 customer complaints and an investigation by the Central Consumer Protection Authority. A Bloomberg investigation in March found that among the roughly 3,400 physical Ola stores for which it could access data, only about 100 had the required trade certificates — and that authorities had been raiding and shutting down showrooms around the country.

Aggarwal turned down multiple requests to be interviewed for this story. Abhishek Chauhan, a spokesperson for Ola, declined to respond to a list of questions, but stressed “the complexity, scale, and ambition of what is being built. Issues wherever they have arisen, have been addressed transparently, whether through improvements and expansion of sales and servicing network, or ongoing investments in customer experience and product safety.”

He added, “Bhavish has always showcased an entrepreneurial vision and courage that has challenged the status quo of Indian tech companies. He has led companies that embraced global trends by bringing and developing them for India.”

A former senior executive described Aggarwal as intensely driven by his grand visions: “‘I want to be the fastest person to the market. I want to have the biggest factory. I want to have the most market share. I want to define the electric revolution. I want to destroy the competition.’ These are the things that motivate [Bhavish].”

But, this executive and others said, Aggarwal can also lose interest in the follow-through of his big projects. “Today, I think the only focus is on [Ola] Electric,” another former executive told Rest of World in December. “Something next will come tomorrow.”

Located at a perpetually traffic-choked intersection in Bengaluru, India’s Silicon Valley, Ola’s headquarters sit inside a dreary, glass-fronted office building. Last November, in a cafe a few miles away, I met Zishaan Hayath, one of Ola’s earliest investors.

A fellow graduate of the prestigious Indian Institute of Technology in Mumbai, Hayath had just launched his own successful phone-commerce startup by the time Aggarwal graduated in 2008. Now 43 and also the founder of an edtech startup, he’s candid and affable, with a voice that carried across the cafe. He said he remained impressed with Aggarwal. “Put him in any room, he’ll be one of the smartest guys there,” he told me. “Raw IQ power. Ability to process things, learn new things, read up and just grasp it.”

In 2010, Aggarwal had just quit a post-graduation job at Microsoft to start Ola Cabs with another IIT-Bombay friend, Ankit Bhati. Aggarwal and Hayath would meet weekly at a Mumbai restaurant where Aggarwal always ordered the same dish — tangy lemon chicken — as the pair discussed what Ola could be. Aggarwal was a lean and earnest dominant-caste kid with an easy grin. Ola’s original proposition was to offer a long-distance cab service. Hayath was more impressed with Aggarwal than his idea, and told him to call when he started raising money.

A year later, Hayath got that call. Aggarwal had expanded his concept to include short-distance travel within the city and found two angel investors: Rehan Yar Khan, founder of Orios Venture Partners; and Khan’s friend, Anupam Mittal, the founder of matchmaking website Shaadi.com. The duo put together around 5 million rupees ($58,600), with smaller investments coming in from Hayath and others. Khan recalled Aggarwal going to a Mumbai restaurant frequented by celebrities and expats to hand out his card. The early goal, Khan told Rest of World, was to get to 100 rides a day.

By the end of 2011, Ola was clocking more than 50 rides a day, just enough to keep the lights on at the office that doubled as Aggarwal and Bhati’s apartment, Khan recalled. Then Khan got a surprising email from a friend, who told him that an American investor wanted to speak with him about Ola. It was Lee Fixel, then a partner at the New York-based investment firm Tiger Global Management. Fixel was becoming known, Khan said, for a simple strategy: Look for the next Amazon, the next Grubhub, or the next Uber in the crowded parts of the world and inject them with funding. (Fixel couldn’t be reached for comment.) Fixel said he had nothing to do over the holidays, Khan said, “so he started poking around to see if there is an Uber in India.” Khan put Fixel in touch with Aggarwal for a phone call, and the offer came together quickly. Khan recalled being in Abu Dhabi for a Coldplay concert, and running around the city to find a shop where he could print the papers he needed to sign.

Tiger Global pledged an initial investment of around $4 million, then co-invested with another firm the following year for another $20 million. Aggarwal has been defensive over the years about being compared to Uber, pointing out that Ola was his original idea. But in Khan’s telling, Fixel was inspired to put so much cash into such a small and relatively unknown startup thanks to Uber’s headline-grabbing rise. Following the investment, the company grew, and Ola was operational in about a dozen Indian cities by mid-2014 and clocking thousands of rides every day.

Ola’s quick rise caught the attention of Masayoshi Son, the CEO of SoftBank, who visited India in 2014 with the intention of expanding his venture capital empire to the country’s rapidly growing e-commerce market. Former SoftBank executive Alok Sama has recounted negotiating its investment with Aggarwal, settling at $210 million, while SoftBank made a similar deal with the two young founders of an Amazon-like website. As Uber and Amazon knocked on the Indian market, Sama writes in his 2024 book, “I was rooting for my ‘chill, normal dudes’ in their battle against America’s brashest exponents of capitalism.”

Namas Bhojani/Bloomberg/Getty Images

The yearslong battle with Uber would transform Ola — and Aggarwal along with it, according to people who worked with him at the time. Travis Kalanick, the co-founder of Uber, was fast-moving, given to flouting regulatory norms, and cutthroat. Before 2014, “he was quite a chilled-out guy,” Khan recalled of the pre-Uber Aggarwal, “this kid roaming around in shorts with his SLR camera.” He continued, “The phase two of Bhavish was the entry of Uber into India. That changed him as a person because it was a bloodbath, it was intense competition. … You had to be impatient back then, because you were fighting a do-or-die battle with the other guy [Kalanick], who was super impatient.”

While using the SoftBank investment to absorb Ola’s main domestic competitor, TaxiForSure, Ola allowed users to pay for the ride in cash, then the primary mode of transaction in India. Ola was also the first to offer auto-rickshaw rides on its app, further increasing its reach, as Aggarwal pushed the company forward with extreme urgency. “There was this blitzkrieg,” recalled a former executive, describing the company going into “steroids mode” with launches in city after city.

For the time, it seemed Aggarwal had checkmated Uber. The battle with Uber also taught him to evolve his thinking, the same former executive said, from “great depth to phenomenal width.” To run a successful cab-aggregating business was no longer enough — Ola had to become a full-on tech company. “And anything to do with any dimension of mobility, we want to throw our hat in there, right? And before we knew it, we had new experiments,” the executive said.

Most of these experiments — food-delivery services, an e-commerce venture, a platform for selling used cars — either fizzled out or were seemingly put on the back burner. But in 2017, Aggarwal registered Ola Electric, a subsidiary of Ola Cabs. It received scant public attention until 2019, when it secured major investments from Tiger Global, Matrix Partners, and SoftBank.

Then came the pandemic, which brought Ola’s ride-sharing business to a screeching halt. The Indian government enforced one of the most severe lockdowns on the planet with only essential workers allowed to venture outside. The pandemic would ultimately shrink Ola’s revenue by 65% by late 2021.

Dhiraj Singh/Bloomberg/Getty Images

With the company’s ride-hailing business staring at an uncertain future, former executives told me, Aggarwal became hyperfocused on the idea of building electric scooters. India, the fifth-largest economy in the world, is a country where 10% of the population owns 77% of the wealth and very few people can afford cars. As a result, around 250 million people in a country of 1.4 billion rely on mopeds, scooters, and motorcycles. For much of the past 20 years, the two-wheeler market was dominated by Honda, with its Activa model becoming practically synonymous with scooters in the country. Meanwhile, India’s domestic scooter giants, Bajaj and TVS, had fallen behind.

By 2019, only 1% of vehicles sold in India were EVs, and among India’s established scooter brands, only Hero offered electric drivetrains. But with petrol prices rising, global battery technologies improving, and EV hype taking hold globally, Aggarwal reasoned, electric scooters were a perfect product for India.

In May 2020, Ola Electric acquired a Dutch e-scooter manufacturer called Ertego in a distress sale. Ertego’s Appscooter became Ola’s prototype model, and helped Aggarwal catch up with his domestic competitors, who were years ahead in research and implementation. The next step was to ramp up the production speed. By the end of 2020, according to people who worked with him at the time, Aggarwal had decided to build a massive scooter-manufacturing factory three hours south of Bengaluru, scaled to produce 2 million scooters annually. He fell into a mad rush to start deliveries, hoping to make the scooter as cheap as possible and claim the biggest share in the untapped market. He set himself, and everyone around him, a seemingly impossible timeline.

“Everyone told Bhavish that it will take two years to build the factory,” a former senior executive at Ola told me. “He built it in eight or nine months.”

Stepping into the Ola conference room in early 2021 must have felt like walking into the inner workings of Aggarwal’s brain. He’d pasted rainbow-colored Gantt charts floor to ceiling around the room. This was the operations center for Ola’s ambitious new plan to launch an EV scooter factory. And not just any factory — one advertised to be the biggest two-wheeler factory in the world, spread across 2 million square meters (500 acres). Ola had just one problem: The company had never built a factory.

By all accounts, Aggarwal was a quick learner. Three Ola executives, who were part of frenetic daily meetings at the time, told me Aggarwal involved himself in everything from land surveying and excavation to acquiring building materials and the equipment for the assembly lines, hiring security for the site, bringing on construction crews and a workforce, and even calculating things like the amount of industrial oxygen the facility would need for metal cutting.

Each detail was a line item on the Gantt charts: endless rows of color-coded cells outlining individual tasks and their schedules in the process of construction. “To build a factory and get it production-ready — you can imagine the number of line items in these Gantt charts,” recalled the former senior executive. “They were these long Excel sheets. And he got them pasted in his meeting room. Two walls were covered ceiling to floor in those [pages].”

Aggarwal spent endless hours in that room, multiple sources said. He would call staffers in, ask for updates, and send them out with new instructions. He’d stand on a chair to point at specific lines on the printed charts, and ask specific questions about everything from concrete to lithium. “What about this? Where is that? Is this finished? He would have an input on every single line, and there were thousands of lines,” the former senior executive said. “You couldn’t bullshit him, because he was always prepared. He knew what he was talking about.”

When construction of the factory was completed in August 2021, Ola advertised the plant as “ground zero” for India’s coming EV revolution. On August 15, India’s Independence Day, Aggarwal declared the factory’s launch in a video address from its roof. He stood smiling and wide-stanced before a rolling camera, dressed in dark jeans and an open-collar blue shirt, its sleeves rolled up. He layered it with a fluorescent visibility vest bearing the Ola logo. “The past paradigms of manufacturing were built in China, but the future of manufacturing will be written in India,” he declared, bringing the tips of his outstretched fingers together for emphasis. “A revolution that we will start here in India and then take around the world.”

Dhiraj Singh/Bloomberg/Getty Images

But even amid the celebrations that August, some executives thought they saw cracks forming. A former group vice president remembered watching the big sales screen that had been installed in the Ola offices as it filled with bookings: “I thought, wow, people are really going to give him their money.”

The 100,000 reservations in the first 24 hours were a major step toward Aggarwal’s dream of turning electric scooters into a mass product in India. It was an idea with government backing: Prime Minister Narendra Modi had said the previous year that he wanted India’s share of EVs to rise from 1% to 30% in a decade, and supported government subsidies to make that a reality. Those subsidies brought down the price of an Ola scooter by a third.

Over the next three years, Ola jump-started a largely dormant electric scooter market, making a popular, viable product. Vloggers met in cities with their Olas and made videos encouraging others to go electric. Some recorded themselves taking their scooters on long-distance rides from Mumbai to the holiday destinations of Goa and Lonavala. Others took their Olas off-roading in the Himalayan foothills. Seemingly every announcement Ola made about its scooters generated press headlines, feeding the excitement.

Between 2022 and 2024, Ola sold almost 800,000 scooters, about a third of all electric scooter sales in India. During that same period, India’s market for electric two-wheelers quadrupled to 6% of overall sales in the segment. Ola’s success seemed to impel the established giants who’d so far thought of their electric offerings as niche products: In the summer of 2022, TVS updated its iQube electric scooter with a better range and lower price. Bajaj followed suit the next year with its Chetak and Urbane models. Yet despite their decades of manufacturing experience, Ola held a strong lead.

The Ola factory, meanwhile, was also widely celebrated. In August 2023, the facility reportedly employed an all-women manufacturing workforce of 3,000 people, an exceptional departure from the norm in a country where men make up more than 80% of the workforce in this sector. The operating system for its scooters was developed in-house. As Ola worked to build a network of exclusive servicing centers across the country, it also bypassed the traditional brick-and-mortar dealership advantage of traditional scooter makers, starting with digital-only sales via a new app.

Even as reports of defective scooters and faulty customer service emerged, Ola maintained its momentum. Ahead of Ola Electric’s August 2024 IPO — the first for a major Indian automaker in two decades — a Bloomberg columnist captured the excitement by calling the company “a proxy for revival of India’s stunted manufacturing ambitions.”

In March, I took a cab to an Ola service station in Delhi, one of hundreds across the country and among the busiest in the capital. Located in a garage behind a shopping complex, it had no external branding. I found it by following a trail of broken scooters that stretched out to the road. Inside, amid a heap of cardboard boxes and scattered spare parts, a few mechanics were fiddling with Ola scooter carcasses.

This was the same service station that a disgruntled customer had suggested setting aflame six months prior. On the day of my visit, though, things were calm. A customer sat patiently on a broken chair while waiting to get his brakes fixed, and told me he was happy enough with his scooter. I asked the manager, a middle-aged man in a T-shirt and jeans, how things had been in recent months with Ola constantly in the news for complaints about its service network. He told me it was because of the rains, and that when the scooters get wet in the rain, they “start acting up.” With a salesman’s zeal, he assured me the next version of Ola scooters would overcome such problems: “Gen 3 won’t be suffering under rain.” (Ola has said its scooters function well in the rain.)

Angry customers, a falling stock price and market share, and a scooter whose riders report many types of malfunctions — how had it come to this for Ola Electric?

Troubles with the scooters started early on. Nearly eight months after launch, in March 2022, a report of an Ola scooter catching fire emerged online, prompting a government investigation. The company responded proactively, recalling more than 1,400 scooters in what they called a “pre-emptive measure.” Sales slowed for several months, then resumed their steady rise, even amid continued reports of scooter accidents and malfunctions. In 2023, Ola sold more than 260,000 scooters, emerging as an industry leader. By March 2024, it sold more than twice the number of electric scooters of its closest competitor, TVS, marking the height of its popularity. Since then, apart from a period of excitement generated by Ola Electric’s stock-market debut, its sales have been in free fall.

The company squandered its early momentum on the market, Vivek Kumar, a Bengaluru-based automotive project manager at the analytics and consulting firm Global Data, told Rest of World. “Issues such as operational inefficiencies, limited innovation, and shortcomings in after-sales service have dampened consumer demand,” he said, adding that Ola’s “hurried” and “premature” scooter launch had led to “early-stage problems, including battery fires and mechanical failures” that eroded customer trust. The celebratory vlogs that once boosted the Ola brand were eventually overshadowed by videos of customers stuck with their unmoving scooters on the side of the road.

Ola’s app-only sales model also ultimately proved limiting, leading the company to open 4,000 showrooms, some of which now face government shutdowns and raids in response to customer complaints. TVS and Bajaj, which have thousands of storefronts and dealerships around the country and whose advertising jingles are recognizable to generations of Indians, have eaten away at Ola’s market share. In January 2025, both companies matched Ola in electric scooter sales. In February and March, they raced ahead.

Ola has also fallen behind Ather Energy, the buzzy Bengaluru-based e-scooter startup. In February, according to government data, Ola sold just over 8,600 scooters, down from some 34,000 the previous year, while Ather sold 11,994 units. Ola has attributed the drop in sales to “disruptions” in its vehicle registration process. Citing the same purported issue, the company has not disclosed its sales data for March. Indian financial journalists have pushed back against Ola’s explanation. (The government’s next report on vehicle registration data is expected on May 1.)

Several executives who spoke to Rest of World raised concerns about Aggarwal’s management style. He can be a brilliant, hands-on, demanding boss, executives told me, but also severely impatient, berating his senior staff using language so vulgar that when I asked for examples — whether we were in an office, a cafe, or a bar — three interviewees lowered their voices to a whisper out of politeness before answering. But in conference rooms, Aggarwal would bark these lines at the top of his lungs. “How many times do I have to explain this to you, madarchod [motherfucker]?” a senior executive recounted Aggarwal saying, while the former group vice president recalled, “You are so fucking stupid, behenchod [sisterfucker], you don’t even get it that you don’t get it.”

The former group vice president described Aggarwal as brash but fair, and saw some of his frustrations with his subordinates as valid. “I had never seen him ask a nonprofessional question in the meetings,” this person recalled, blaming Ola’s executives for too often failing to provide adequate answers. “They crumble after questions, and then [Aggarwal] would get even more angry.”

Three former executives told me they saw Aggarwal throw pens at people to get their attention. Two of them said they saw him tear pages and smash laptops on tables to express disappointment or impatience. Sometimes, to show everyone he had had enough, Aggarwal would, without saying a word, get up and walk out of the conference room and out of the building, and sit on a patch of grass outside. Back in the conference room, some of the highest paid executives in India’s startup industry sat anxiously, wondering when it might be safe to approach him. “Anything could tick him off,” the former group vice president said.

“[Ola] is a solar system,” a former senior executive told me, with Aggarwal as the sun — “the hottest part.” Pressing on with his metaphor, he continued: “At my [level of] involvement, I was probably Earth or a little beyond. But there were people right next to it … Mercury and Venus. I would see them occasionally burning. I could see the instant terminations happening, public humiliations.” Then the Venus and the Mercury were gone, and the executive took their place: “The closer you are to the sun, the more uninhabitable it becomes.”

In just the past year, Ola Electric — which had an employee attrition rate of 47% in fiscal year 2023 and 44% in fiscal year 2024 — saw the departures of a group vice president, chief marketing officer, chief product officer, and head of sales, among others. Ola’s cabs vertical lost its chief financial officer, chief business officer, and chief executive officer. At Ola Krutrim, Aggarwal’s artificial-intelligence venture, the business head departed.

Such a high turnover rate hurts a company’s ability to attract and retain top talent and “affects a lot of things like project continuity,” N Shivakumar, a Bengaluru-based human resources expert, told me. It should also, he added, lead to questions from investors, since “how well you’re doing internally … makes it very evident how well you can do externally.”

Chauhan, the Ola spokesperson, did not respond to questions about Aggarwal’s management style or alleged problems with the company’s scooters and business. “At Ola, we take immense pride in having built three futuristic businesses — Ola Consumer, Ola Electric, and Ola Krutrim — each of which has been a category creator and a force multiplier for India’s positioning in the global innovation ecosystem. From fundamentally transforming personal transportation in India to launching one of the world’s largest two-wheeler EV manufacturing facilities run by an all-women workforce, to building India’s own AI models and supercomputers through Krutrim, these are not incremental achievements — they are bold, nation-building milestones,” he said.

“We categorically reject any insinuation that prioritizes speed over safety, or vision over responsibility,” Chauhan added. “Ola Electric has a community of a million strong customers, holds a market-leading position in EV two-wheelers, and has catalyzed an entire ecosystem of EV mobility. That journey, like all cutting-edge innovation, came with its unique set of challenges, but the company’s resolve remains unwaveringly forward.”

While Aggarwal’s subordinates see much in his mindset and behavior to remind them of the popular image of Elon Musk — whom Aggarwal has said he admires — there is also a crucial difference. Though Tesla also has high turnover, Musk has kept some of his top deputies, like Steve Davis (originally of SpaceX) and Lars Moravy (Tesla), in his close circle for years, even decades. “Elon has … these people, this team, and he makes sure that this team — while they might be having a tough time — remain constantly motivated by the larger vision,” one former executive who worked closely with Aggarwal for two years told me. But Aggarwal, this person continued, “doesn’t trust anybody” to run his businesses for him, and “won’t let them do their jobs without constant interference.”

One essential similarity between the two is that both are the privileged sons of segregated societies. The Aggarwals are among the most influential clans in the Bania community, historically one of the most affluent classes in the matrix of India’s caste system. The two richest Indians are both Banias, as are the founders of a number of prominent Indian conglomerates, and the tradition carries through to Indian startups. At least one of the founders of Ola, Flipkart, Snapdeal, Myntra, Zomato, Urban Ladder, IndiaMart, Oyo Rooms, Lenskart, and Shaadi.com — 10 prominent Indian tech companies — is a Bania. Firms founded or run by an Aggarwal received 40% of all investment into India’s e-commerce sector in 2012, according to India’s top-selling financial newspaper, which was the year Ola got its first round of funding. Most Indians can’t come close to this access to social networks and capital, or premier schools like the IITs that are almost a prerequisite to enter Indian startups. “I am a Bania,” Aggarwal told an interviewer in 2023, describing his path to becoming a businessman. “I had those genes in me.”

Aparna Jayakumar/Bloomberg/Getty Images

In recent months, as China’s DeepSeek grabbed headlines and Silicon Valley leaders, including Musk, continued to pivot toward artificial intelligence, Aggarwal’s focus seemingly shifted to Krutrim AI, which he has said will be a ChatGPT-like large language model with “Indian cultural sensibilities.” Ola Krutrim already has a billion-dollar valuation, with $50 million from the India arm of Matrix Partners, which stood to make nearly 10 times its investment in Ola Electric’s IPO. Aggarwal has also partnered with Nvidia to develop an Indian supercomputer. In February, two weeks after the release of DeepSeek’s AI chatbot, he announced he’d be investing $230 million in Krutrim. Over the next year, Aggarwal posted on X, he aims to quintuple that investment: “Our focus is on developing AI for India.”

In March, even as Ola Electric started delivering its third-generation scooters, it announced plans to slash over 1,000 jobs due to projected losses and declining market share. The cuts will take hold across departments including procurement, fulfilment, charging infrastructure, and customer relations.

Many Ola Electric customers, meanwhile, are still stuck with their scooters. When Panda, the product designer in Pune, recovered from his accident, he told me, his LinkedIn post about the ordeal had drawn significant attention. As like-minded Ola users, along with many of Aggarwal’s critics, shared the post widely, Ola’s customer care got in touch and took back the vehicle to make repairs. “They told me we have made the changes. They restored multiple things, they have changed the body,” Panda recalled. “And they told me to delete the post.” (Rest of World could not independently verify this exchange.)

He refused, and his scooter was repaired and returned free of charge. “Right now I’m not facing any issues,” he said. “But I’m just waiting for it. The issue will come back.” When I asked if he was afraid to ride the scooter, he responded, “What choice do I have?”

As it turned out, Panda had started freelancing at a startup in the business of two-wheeler EVs: It manufactures electric bikes. The company’s mindset is to build methodically — and, as its modest funding shows, it is unlikely to attract major attention in India’s competitive startup industry. “We are running very slow,” Panda said. “For the past one year, we are working on just the one product. Our whole mindset is make the product [safe], then release it to the customer.”

#spectacularrise #crash #Indias #largest #company

Thanks to the Team @ Rest of World – Source link & Great Job Atul Dev