Alabama Tried a Trump-Like ‘Frankenstein’ Immigration Overhaul. It Ended Badly.

February 21, 2025

Medicare Defenders Slam ‘Obscene’ Looming Cuts to Telehealth Coverage | Common Dreams

February 21, 2025 Sean Starrs

There are various ways that the world dominance of American TNCs boosts American state power. The global dominance of Wall Street (financial services in figure two), for example, helps to ensure that the US dollar remains the de facto world currency.

The dominance of American tech firms helps to ensure the continued supremacy of the US military, while the dominance of American media helps to ensure that the US state can shape the ideological narrative (including support for US capitalism and imperialism). In general, the dominance of American TNCs ensures that the US state can leverage them in various ways as both carrot and stick against other capitalist powers.

The best recent example of how this dominance enhances US state power is the US tech war against China that began in 2019 under Donald Trump and really ramped up under Joe Biden. American firms have virtual monopolies in various crucial technologies, from smartphone operating systems to semiconductor design software, and the US state can pressure its allies whose TNCs also have crucial monopolies (like ASML from the Netherlands). This means the US state can severely constrict China’s continued global tech competitiveness in advanced semiconductors, artificial intelligence, supercomputing, etc.

Notably, Huawei was China’s most technologically advanced global competitor in the 2010s. Its smartphones were briefly world number one in the second quarter of 2020. After the US Department of Commerce placed Huawei on its “Entity List” in May 2019, embargoing US TNCs from doing business with them, they could no longer update their Google Android operating system nor access the most advanced semiconductors.

Huawei’s global market share in smartphones went from 20 percent in Q2 2020 to zero outside of China from 2021 to the present. Within China itself, Huawei’s smartphone market share peaked at 45 percent in Q2 2020 then collapsed to zero by Q1 2021 to Q2 2023, crawling back to fourth in China by Q3 2023 (Apple being number one). The United States can destroy the global prospects of one of China’s most competitive tech companies without China being able to do anything about it, demonstrating extraordinary American power.

Even more startling is what the Biden administration was doing from October 2022 onward. They banned American TNCs (and even US citizens and green card holders) from doing business or research in the advanced semiconductor industry in China. If the United States can successfully cut China off from the most advanced semiconductors, then this will have immense ripple effects for further advancement across all technology sectors in China.

While the example of DeepSeek has shown us that China can still be extraordinarily adaptable within these constraints, essentially developing a more efficient copy of ChatGPT using much less resources (and third-tier Nvidia chips), this is not the same as actually innovating in the field of artificial intelligence (AI). Moreover, scaling DeepSeek will still require huge computers powered by Nvidia chips that will likely face further US-imposed restrictions. Alphabet, Amazon, Meta, and Microsoft have an enormous structural advantage in this regard (with unrestricted access to the world’s most advanced chips). They announced more than $300 billion of AI investment for 2025 alone weeks after DeepSeek’s R1 release.

In this way, the US state can leverage the global dominance of US TNCs to contain the further technological rise of the country with the second-largest GDP in the world. This represents extraordinary power that the US state did not possess in its attempt to contain Soviet technological advancement from the 1950s onward, as the Soviets outcompeted the United States in various technologies (intercontinental ballistic missiles, rockets, satellites) for a couple of decades.

There are some, however, who will sidestep these issues because of what my late supervisor Leo Panitch described as “impoverished state theory.” Particularly since the explosion of globalization discourse during the 1990s, there has been a tendency for many people to think that the world’s top TNCs have been able to “escape” the nation-states in which they were historically domiciled, even becoming more powerful than states. This leads some to think that the very idea of national economic power is anachronistic in the age of globalization, and that global TNCs such as Apple, Toyota, or Volkswagen are not really “American,” “Japanese,” or “German” in any meaningful sense.

This conceptualization of globalization and TNCs is wrong. States always have more power than individual TNCs, even if many states choose to not use this power. A coalition of more than six hundred US companies and trade associations urged Trump not to impose tariffs on China, the big Wall Street players were very unhappy about the tariffs, and thousands of firms filed lawsuits against the Trump administration, including the likes of Ford and Coca-Cola. But even the most powerful corporations in the world must ultimately follow the diktats of the US government. If the nationality of TNCs no longer matters in the age of globalization, then companies that wanted to evade the restrictions on trade with China would just move their operations out of US territory — but they can’t.

In my research, I have mapped out the national ownership structures of the Forbes Global 2000. Globalization theorists assume that the world’s top TNCs have owners dispersed around the world, representing a “transnational capitalist class.” This is wrong. What we have actually seen is the globalization of American ownership of the world’s top corporations.

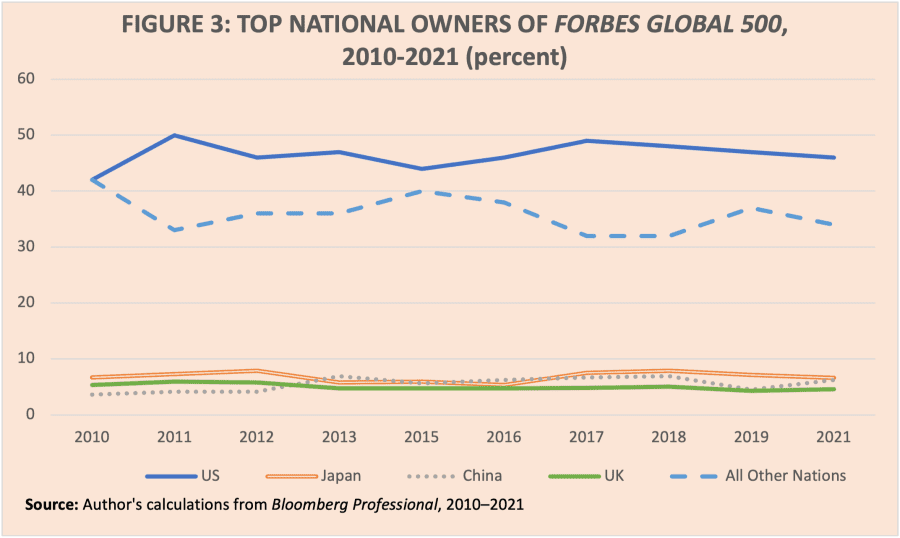

Not only do American capitalists still own a predominant share of US TNCs (on average 81 percent, based on ownership data from 2021), but they increasingly own more and more of TNCs based around the world. On average, American capitalists own 46 percent of the total outstanding shares of the world’s top five hundred TNCs (see figure three), even though only 35 percent of those TNCs are domiciled in the United States. The second-biggest national owner of the world’s top five hundred are Japanese capitalists with 6.6 percent ownership, even if Japanese firms account for 8.6 percent of the 500.

This increasing globalization of American ownership is true even of Chinese state-owned enterprises, with Americans owning 9.7 percent of the top fifty. Hence American capitalists own more of China’s top state-owned enterprises than the biggest foreign owner owns of the top fifty US TNCs (British ownership with 5.6 percent). Moreover, American capitalists also own 21 percent of the top fifty Japanese TNCs and astonishingly 34 percent of the top fifty European TNCs, more than triple the share of any single European nation.

In this way, the United States has structured global capitalism so that American capitalists still profit whether or not Apple (84 percent US-owned) can outcompete its archnemesis Samsung Electronics (29 percent US-owned vs 42 percent South Korean). This partly explains why 22 million of the world’s 58 million millionaires are American in 2023 (38 percent, significantly higher than the US share of world GDP at 26 percent), according to the 2024 Credit Suisse World Wealth Report — roughly similar to the US share of capitalist wealth in the 1950s.

Great Job Sean Starrs & the Team @ Jacobin Source link for sharing this story.